ECONOMIC OUTLOOK AND INDICATORS IN GEORGIA

HOTEL PRICE INDEX

PMC RESEARCH - IFO GEORGIAN ECONOMIC CLIMATE

BLACK SEA BULLETIN

QUARTERLY TOURISM UPDATE

ECONOMIC OUTLOOK AND INDICATORS IN UKRAINE

SECTOR SNAPSHOTS

EMPLOYMENT TRACKER

MACRO OVERVIEW

BAG Index

Profile Of Bilateral Relations

Monthly Tourism Update (September, 2022)

12-Oct-2022

Since the outbreak of the war in Ukraine, the border crossing statistics have shown significant differences in the number of entries and exits by Russians, Belarusians, and Ukrainians. From January to September 2022, the difference between entries and exits of citizens of Russia was equal to 58.6 thousand unique persons.

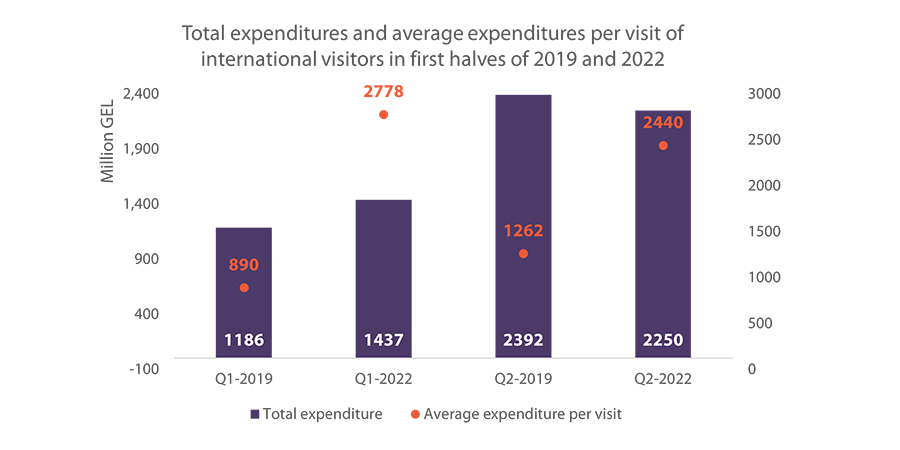

Despite only a partial recovery in the number of international visits, in Q1 of 2022, the total expenditure of international visitors exceeded the pre-pandemic (Q1 of 2019) value by 21%, while in Q2 of 2022, the total expenditure was only 6% lower than Q2 of 2019.

The average expenditure per visit tripled in Q1 of 2022 and almost doubled in Q2 of 2022, compared to the corresponding periods of 2019. This could be explained by the fact that in the first half of 2022, the average length of stay almost doubled as it increased from 3.8 to 6.4 nights.

Monthly Tourism Update (August, 2022)

19-Sep-2022

In the third quarter of every year between 2016 and 2020, the number of international visits to Adjara, on average, amounted to 42% of total international visits to Georgia, while contributing up to 14.9% of all domestic visits.

Throughout the past few months, in Adjara in particular and Georgia in general, significant hotel price increases have been evident due to a combination of factors, such as the marked recovery of international tourism, the rapid inflow of Russians, Belarusians, and Ukrainians since the beginning of the Russia-Ukraine war, higher demand for Georgian tourist destinations among domestic visitors, and a rise in prices for essential goods for hotel maintenance.

In the summer of 2022, a significant increase has been observed in average hotel prices compared to the pre-pandemic level in Georgia. Specifically, price increases have been especially apparent in Adjara. Average hotel prices there increased by 16% compared to 2019 and by 25% compared to 2021. Meanwhile, in Batumi, average summer prices compared to the same two years increased by 17% and 23%, respectively.

Monthly Tourism Update (July, 2022)

16-Aug-2022

In the past few months, significant increases in hotel prices have been evident due to a combination of factors, such as the partial recovery of international tourism, the rapid inflow of Russians, Belarusians, and Ukrainians since the beginning of the war, a higher domestic tourism demand among Georgians, and the increase in prices for essential goods for hotel services.

Monthly Tourism Update (June, 2022)

20-Jul-2022

Since the outbreak of the war in Ukraine, the border crossing statistics have revealed significant differences in the number of entries and exits by Russians, Belarusians, and Ukrainians. In May 2022, the gap between the number of entries and exits declined significantly with the number of exists increasing significantly for Ukrainians, while in the same month, for Russians and Belarusians, the number of exits exceeded the number of entries.

Since the beginning of the war in Ukraine, travel receipts from Russia have shown a significant increase, while in March 2022 receipts from Belarus experienced a drastic jump of 552% compared to February 2022 and this high level has been maintained for the following three months.

Monthly Tourism Update (May, 2022)

14-Jun-2022

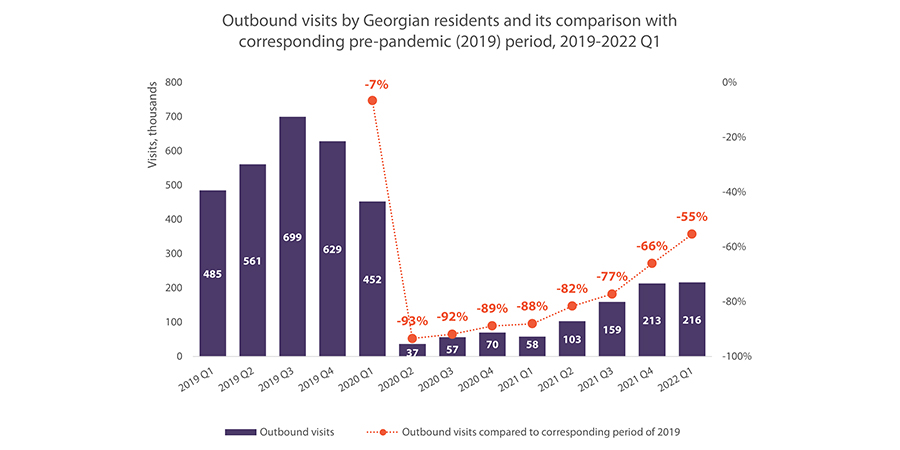

• Following the easing of travel restrictions by many countries, the outbound international visits by residents of Georgia have shown a significant recovery, reaching almost half of the pre-pandemic level by Q1 2022.• The main destination for outbound Georgian visitors was Turkey, followed by Russia, Armenia, and EU countries. • In Q1 2022, the expenditure of outbound visitors reached GEL 285 mln, which is 14% lower compared to Q1 2020, and 21% lower compared to Q1 2019.

Monthly Tourism Update (April, 2022)

13-May-2022

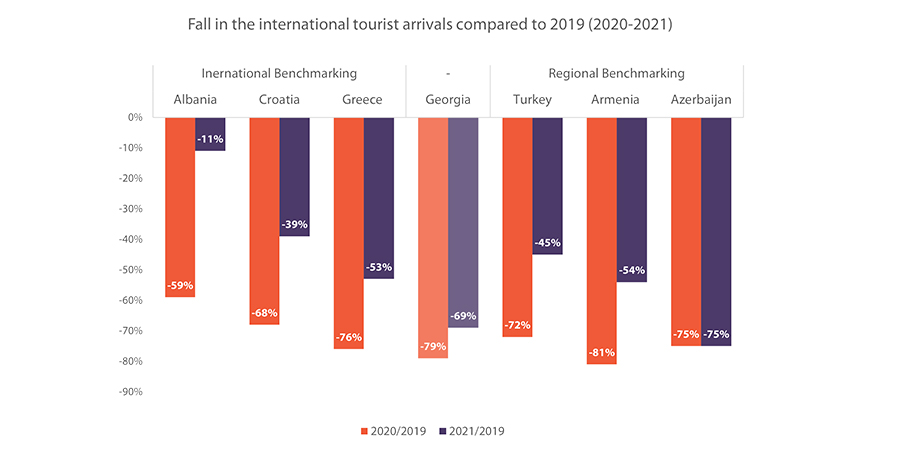

In 2021, the recovery of international tourist arrivals to Georgia (31% of 2019 figure) was lower both compared to European (38%) and Central/Eastern European (36%) averages, but higher compared to the global average (28%).

Among the selected international benchmark countries (Albania, Croatia, and Greece), Georgia performed the worst, while Albania almost recovered to 2019 levels (89%).

Compared to its neighboring countries, Georgia performed worse than Turkey (55%) and Armenia (46%), but better than Azerbaijan (25%).

Monthly Tourism Update (March, 2022)

02-May-2022

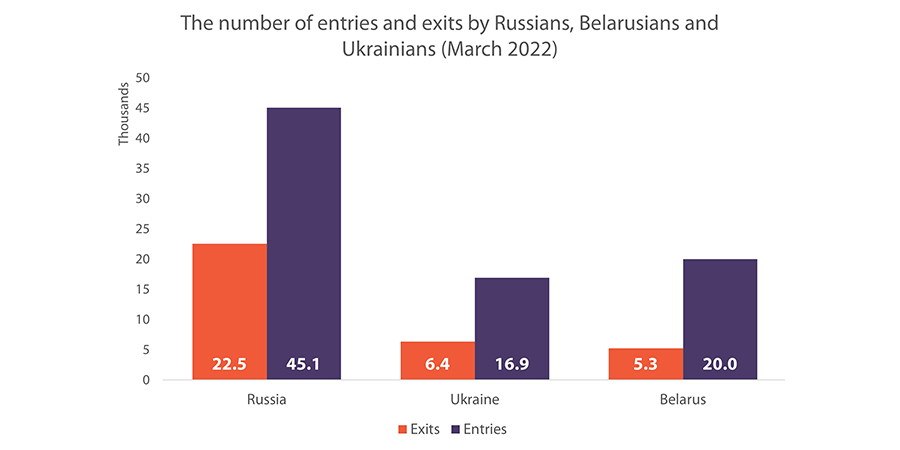

In March 2022, the number of Russian, Belarusian and Ukrainian travelers entering country increased significantly and reached 45.1 thsd, 20 thsd and 16.9 thsd, respectively. The month over month (MoM) increase was especially high for Belarus (281%) and Russia (69%). Meanwhile, the exit from Georgia by Belarusian and Russian visitors has also shown a significant MoM increase.

In March 2022, remarkable differences can be noticed between the number of entries and exits, indicating that significant part of the travelers, especially from Russia and Belarus, have not left the country.

In March 2022, the travel receipts from Belarus and Russia showed MoM increase of 551% and 133%, respectively, which again strengthens the observation of the rapid inflow of travelers from Russia and Belarus.

Monthly Tourism Update (February, 2022)

23-Mar-2022

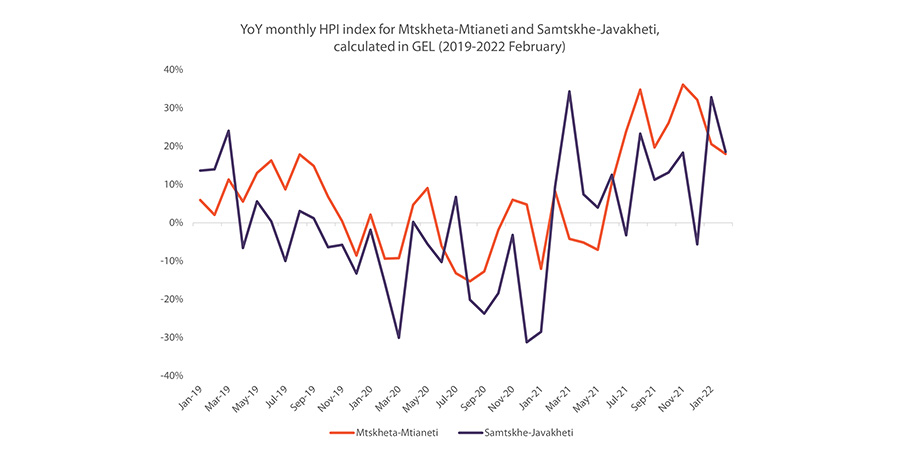

In this issue we will discuss the hotel price dynamics of winter destinations in Georgia.

According to the Georgian National Tourism Administration (GNTA), Mtskheta-Mtianeti and Samtskhe-Javakheti have been among the top visited regions in winter season, largely due to major ski resorts (Gudauri and Bakuriani) being located there.

Throughout 2020, the YoY HPI was negative for both regions, with a more pronounced YoY decline in Samtskhe-Javakheti. As 2021 wore on, hotel prices increased significantly and from December 2021 to February 2022 the HPI in Mtskheta-Mtianeti averaged 23.5%, while for Samtskhe-Javakheti it was 15.2%.

The average monthly hotel prices were higher in Mtskheta-Mtianeti region compared to Samtskhe-Javakheti from January 2019 to February 2022. In particular, during winter months the average hotel price in Mtskheta-Mtianeti was 175 GEL, which was 12.9% higher compared to Samtskhe-Javakheti (155 GEL).

Monthly Tourism Update (January, 2022)

21-Feb-2022

The number of international travelers increased by 471.2% in January 2022, compared to the same period of 2021, and declined by 62.3% compared to the same period in 2019. Meanwhile, the number of international visitors increased by 424.4% (2022/2021) and declined by 59.5% (2022/2019), and the number of international tourists increased by 455.7% (2022/2021) and declined by 46.5% (2022/2019).

In January 2022, the Hotel Price Index (HPI) showed a significant 5.3% increase in prices compared to 2021, with the highest price increases recorded in Samtskhe-Javakheti (32.8%) and Mtskheta-Mtianeti (20.6%) regions.

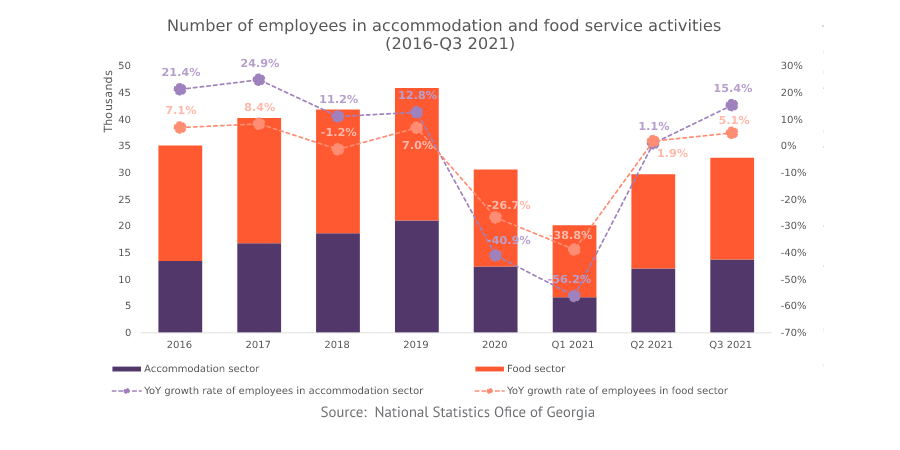

The number of employees in the HORECA industry increased steadily from 2016 to 2019 with an average annual growth rate of 10.1%. However, in 2020 the number of employees dropped by 33.2%. Even though some positive trends have emerged since Q2 of 2021, the number of employees in the industry is still well below pre-pandemic levels.

The nominal average monthly salaries of employees in the HORECA industry also increased steadily throughout the 2016-2019 period. Since the pandemic began, salaries have been declining significantly. However, since Q2 2021, salaries recorded a considerable YoY increase, which can be explained by the high inflation rate, partial alleviation of restrictions, and higher demand in the HORECA industry.

Monthly Tourism Update (December, 2021)

21-Jan-2022

The number of international travelers increased by 249.2% in December 2021, compared to the same period of 2020, and declined by 73.3% compared to the same period in 2019. Meanwhile, the number of international visitors increased by 226.4% (2021/2020) and declined by 69.9% (2021/2019), and the number of international tourists increased by 239.1% (2021/2020) and declined by 53.7% (2021/2019).

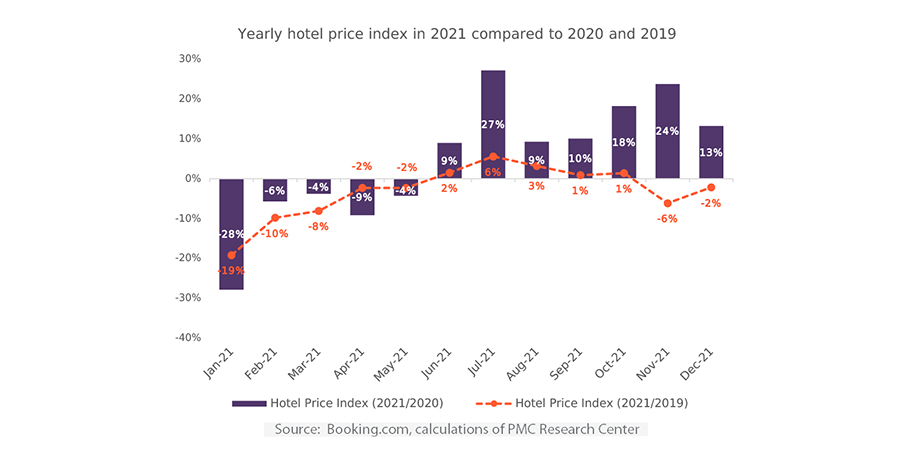

At the beginning of 2021, the Hotel Price Index (HPI) was negative compared to both 2020 and 2019, however the monthly prices showed a significant YoY increase from June 2021 onwards and recovered considerably compared to 2019 levels.

In 2021, the average monthly prices of hotels exceeded both the pre-pandemic level (by 23.7%) and the 2020 level (by 39.1%). Looking at specific categories, the price increase has been most significant for 5-star hotels (by 12.1% compared to 2019 and by 51.4% compared to 2020), while for 3-star hotels the price increase has been least significant (by 4.8% compared to 2019 and by 20.1% compared to 2020).

- Periodic Issues

- ECONOMIC OUTLOOK AND INDICATORS IN GEORGIA

- HOTEL PRICE INDEX

- PMC RESEARCH - IFO GEORGIAN ECONOMIC CLIMATE

- BLACK SEA BULLETIN

- QUARTERLY TOURISM UPDATE

- ECONOMIC OUTLOOK AND INDICATORS IN UKRAINE

- SECTOR SNAPSHOTS

- EMPLOYMENT TRACKER

- MACRO OVERVIEW

- BAG Index

- Profile Of Bilateral Relations